Your credit score rating is among the many essential indicators of your monetary well being, which may affect your potential to acquire the credit score you want. Credit score scores are created primarily based on the info reported by your earlier collectors. The ensuing three-digit rating provides potential lenders or collectors an evaluation of how doubtless you’re to repay your debt.

The perfect factor about credit score scores is that you could step by step enhance them by adopting wholesome monetary habits, relying in your present scenario. Your credit score rating displays the data in your credit score report. So, it might assist in the event you started by understanding what credit score studies are, what they present, and why it’s important to verify them.

What’s a Credit score Report?

A credit score report is a rigorously structured doc ready by credit score bureaus reflecting your credit score historical past and present monetary scenario. Details about your debt reimbursement and the standing of your credit score accounts are included. Collectors, lenders, banks, and different monetary establishments report monetary data to credit score bureaus to construct credit score studies.

Within the U.S., there are three foremost credit score bureaus. Every credit score bureau maintains the identical data in your credit score file. They every arrange the info otherwise and format credit score studies otherwise. The data on all of your credit score studies can also fluctuate as a result of not all companies report back to all three credit score reporting businesses. No matter which credit score bureau builds your credit score report, having an correct and clear credit score report is crucial for many aspects of your monetary life.

Why is a Credit score Report Vital?

Your credit score report’s data serves as the muse for credit score scores, starting from 300-850, that depict your creditworthiness. Lenders usually overview your credit score report to find out whether or not you qualify for a mortgage or line of credit score and what rate of interest to give you.

An extended historical past of on-time funds in your credit score report is a optimistic indicator and contributes to a better credit standing. Thus, you’ll be able to receive bank cards and loans on extra favorable lending phrases. Alternatively, too many missed or late funds, chapter, and different comparable marks can drop your credit score rankings. Decrease credit score rankings will make getting approval for bank cards and loans harder or compel lenders to cost you a better rate of interest. Nonetheless, even with a decrease credit score rating, it’s potential to borrow funds by searching for out lenders that provide horrible credit loans.

Your credit score report is essential as a result of it could possibly affect many points of your life. Apart from acquiring loans or credit score, your potential to lease an house, purchase a home, buy an car, or get employed for a job could also be affected.

That are the Three Credit score Reporting Businesses?

Equifax, Experian, and TransUnion are the three main credit score reporting businesses in america. Every reporting company compiles knowledge primarily based on monetary habits to provide a novel credit score report.

These credit score bureaus collect and promote knowledge about your credit score habits. Nonetheless, corporations who verify your credit score, together with lenders and bank card corporations, will need to have a legit trigger to take action, like screening mortgage purposes. More often than not, they want your consent.

How you can Get a Credit score Report?

It’s smart to observe the data in your credit score report since lenders can use it to evaluate your creditworthiness. There are quite a few paid sources to get an up-to-date copy of your credit score report. You can too qualify for a free credit score report yearly below the federal Honest Credit score Reporting Act.

Go to AnnualCreditReport.com to get a free credit score report from the three foremost credit score bureaus. You can too name to acquire a free credit score report by calling 1-877-322-8228 or obtain a type on-line and ship it to the Annual Credit score Report Request Service, P.O. Field 105281, Atlanta, GA 30348-5281, to request a report.

Bear in mind that the ready interval to obtain a credit score report can vary from a couple of minutes to fifteen days, relying on the way you make your request. The web request type is the quickest technique to entry your credit score report. When you request it by telephone, chances are you’ll obtain your report inside 15 days; in the event you request it by mail, it normally takes about 15 days after every bureau receives your request.

What Info & Paperwork are Required to Get a Credit score Report?

This is an inventory of the important data that you must ship anyone, two, or all three main bureaus to get your credit score report:

- Your title

- Present deal with

- When you’ve lived at your present residence for lower than two years, your earlier deal with.

- Social Safety quantity

- Date of delivery

Credit score reporting corporations could ask you for a number of items of data to authenticate your id. Your month-to-month mortgage fee or bank card limits are sometimes requested. General, receiving a replica of your credit score report has turn out to be considerably simpler over the past decade.

What Does a Credit score Report Present?

All credit score studies include primarily the identical forms of data, even when Experian, Equifax, and TransUnion show your knowledge otherwise. Listed below are the 4 widespread classes of data:

Private Info

A listing of particulars that determine you is included within the private data part of your credit score report. Your title, present and former addresses, social safety quantity, date of delivery, partner or co-applicant data, and telephone numbers are all listed on the prime of the report. This data is up to date primarily based on the info you give lenders whenever you apply for brand spanking new credit score.

Credit score Accounts

This part makes up nearly all of most studies. It incorporates full particulars on all of your credit score accounts, together with installment loans, auto loans, private loans, and mortgages, in addition to revolving credit score like bank cards and contours of credit score. Every reported account can be labeled as Open, Closed, or Detrimental. The main points about all missed funds, charge-offs, or collections actions, are additionally included.

Credit score Inquiries

This part of your credit score report retains account of the inquiries made by companies searching for your credit score report or credit score rating. Your requests for credit score can immediate arduous or delicate inquiries. Bear in mind that whenever you apply for pre-approved credit score, if there’s a arduous credit score verify, These inquiries can keep in your credit score report for as much as two years.

Public Document and Collections

Public information about monetary actions, similar to judgments, tax liens, and bankruptcies, are included on this part. When you file for chapter, you may discover the specifics of your chapter submitting and its standing listed on this credit score report part. Relying on the kind of chapter you apply for, the data will seem and keep in your credit score report for seven or ten years.

It’s important to usually verify the data in your credit score report to make sure that your lenders see probably the most correct credit score scores whenever you apply for credit score. You should notify the related credit score bureau in the event you uncover a mistake in your document.

How Typically Ought to You Test Your Credit score Report?

In response to specialists, it is best to verify your credit score report and rating at the very least as soon as yearly. The data on the credit score studies of all three main credit score reporting businesses can fluctuate, typically by greater than you’ll anticipate. It is best to overview all three to realize an intensive image of your creditworthiness.

Other than the common annual credit score checkup, it is best to overview your credit score report earlier than making important monetary selections. An additional benefit to persistently checking in in your credit score studies is that you’ll acquire insights into potential fraud or id theft.

You would possibly wish to arrange fraud alerts or a credit score freeze in the event you detect any indicators of id theft inflicting errors in your credit score report. It is best to contact one of many three foremost credit score bureaus to arrange alerts. Whenever you report a fraud alert to 1 credit score bureau, that bureau will contact the opposite two bureaus in your behalf. Freezing your credit score will not injury your rating, and chances are you’ll unfreeze it every time that you must apply for any mortgage or bank card.

Who Seems at Your Credit score Report and Why?

Some lenders use these studies to make well-informed selections about whether or not or to not lend you cash and what rates of interest to cost you. In some instances, your credit score report can be utilized by lenders to evaluate whether or not you’ll proceed to stick to the phrases of an present credit score account.

Apart from banks and different monetary establishments, your credit score report is essential for quite a few companies to make selections about you. Potential landlords can look at your credit score report earlier than they resolve whether or not to lease to you. Some organizations even carry out credit score checks on candidates as a part of their hiring course of.

Does Requesting a Credit score Report Harm Your Rating?

No, checking your credit score studies or scores doesn’t have an effect on your credit score rankings. Common checkups are essential in making certain the accuracy of your private and account data and might help in figuring out potential id theft. Requesting on your credit score report is an ideal instance of a delicate inquiry. Your credit score scores are unaffected by delicate credit score checks, that are solely seen to you whenever you verify your credit score report below the credit score inquiries part.

Distinction Between Credit score Report and Credit score Rating

A credit score rating is a single numerical ranking. In distinction, a credit score report collects knowledge about your credit score exercise and present credit score scenario. Your credit score studies considerably affect your credit score scores. That is as a result of knowledge out of your credit score studies is used to assemble credit score rankings. Take into account your scores as a quick synopsis of your credit score report. For that reason, cleansing up the studies is step one to bettering your credit score rating.

Identical to credit score scores, you might have varied credit score studies. Scores may change relying on the info used to generate them.

Conclusion

A credit score report information how you might have beforehand dealt with and repaid debt. When contemplating whether or not to do enterprise with you, lenders and different corporations use it as a type of a report card. Due to this fact, reviewing your credit score studies will help you in understanding your scenario and figuring out any fraud or inaccuracies together with your accounts.

Do not forget that it isn’t the tip of the world if a debt assortment exhibits up in your credit score document. Whereas there will not be any fast cures for fixing your credit score, there are undoubtedly simple steps you need to use to lift your credit score scores over a while.

Your credit score rating is among the many essential indicators of your monetary well being, which may affect your potential to acquire the credit score you want. Credit score scores are created primarily based on the info reported by your earlier collectors. The ensuing three-digit rating provides potential lenders or collectors an evaluation of how doubtless you’re to repay your debt.

The perfect factor about credit score scores is that you could step by step enhance them by adopting wholesome monetary habits, relying in your present scenario. Your credit score rating displays the data in your credit score report. So, it might assist in the event you started by understanding what credit score studies are, what they present, and why it’s important to verify them.

What’s a Credit score Report?

A credit score report is a rigorously structured doc ready by credit score bureaus reflecting your credit score historical past and present monetary scenario. Details about your debt reimbursement and the standing of your credit score accounts are included. Collectors, lenders, banks, and different monetary establishments report monetary data to credit score bureaus to construct credit score studies.

Within the U.S., there are three foremost credit score bureaus. Every credit score bureau maintains the identical data in your credit score file. They every arrange the info otherwise and format credit score studies otherwise. The data on all of your credit score studies can also fluctuate as a result of not all companies report back to all three credit score reporting businesses. No matter which credit score bureau builds your credit score report, having an correct and clear credit score report is crucial for many aspects of your monetary life.

Why is a Credit score Report Vital?

Your credit score report’s data serves as the muse for credit score scores, starting from 300-850, that depict your creditworthiness. Lenders usually overview your credit score report to find out whether or not you qualify for a mortgage or line of credit score and what rate of interest to give you.

An extended historical past of on-time funds in your credit score report is a optimistic indicator and contributes to a better credit standing. Thus, you’ll be able to receive bank cards and loans on extra favorable lending phrases. Alternatively, too many missed or late funds, chapter, and different comparable marks can drop your credit score rankings. Decrease credit score rankings will make getting approval for bank cards and loans harder or compel lenders to cost you a better rate of interest. Nonetheless, even with a decrease credit score rating, it’s potential to borrow funds by searching for out lenders that provide horrible credit loans.

Your credit score report is essential as a result of it could possibly affect many points of your life. Apart from acquiring loans or credit score, your potential to lease an house, purchase a home, buy an car, or get employed for a job could also be affected.

That are the Three Credit score Reporting Businesses?

Equifax, Experian, and TransUnion are the three main credit score reporting businesses in america. Every reporting company compiles knowledge primarily based on monetary habits to provide a novel credit score report.

These credit score bureaus collect and promote knowledge about your credit score habits. Nonetheless, corporations who verify your credit score, together with lenders and bank card corporations, will need to have a legit trigger to take action, like screening mortgage purposes. More often than not, they want your consent.

How you can Get a Credit score Report?

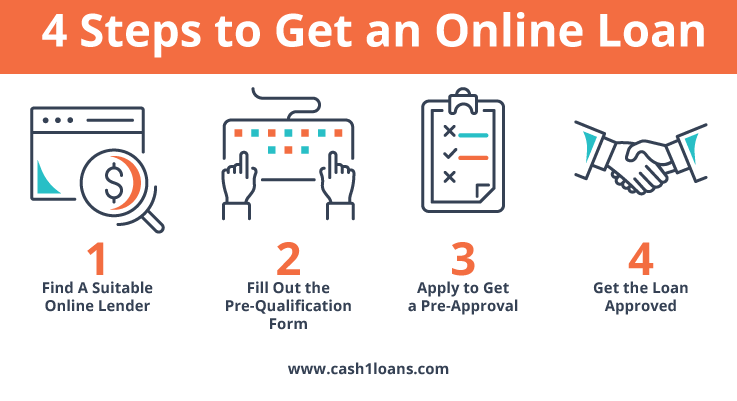

It’s smart to observe the data in your credit score report since lenders can use it to evaluate your creditworthiness. There are quite a few paid sources to get an up-to-date copy of your credit score report. You can too qualify for a free credit score report yearly below the federal Honest Credit score Reporting Act.

Go to AnnualCreditReport.com to get a free credit score report from the three foremost credit score bureaus. You can too name to acquire a free credit score report by calling 1-877-322-8228 or obtain a type on-line and ship it to the Annual Credit score Report Request Service, P.O. Field 105281, Atlanta, GA 30348-5281, to request a report.

Bear in mind that the ready interval to obtain a credit score report can vary from a couple of minutes to fifteen days, relying on the way you make your request. The web request type is the quickest technique to entry your credit score report. When you request it by telephone, chances are you’ll obtain your report inside 15 days; in the event you request it by mail, it normally takes about 15 days after every bureau receives your request.

What Info & Paperwork are Required to Get a Credit score Report?

This is an inventory of the important data that you must ship anyone, two, or all three main bureaus to get your credit score report:

- Your title

- Present deal with

- When you’ve lived at your present residence for lower than two years, your earlier deal with.

- Social Safety quantity

- Date of delivery

Credit score reporting corporations could ask you for a number of items of data to authenticate your id. Your month-to-month mortgage fee or bank card limits are sometimes requested. General, receiving a replica of your credit score report has turn out to be considerably simpler over the past decade.

What Does a Credit score Report Present?

All credit score studies include primarily the identical forms of data, even when Experian, Equifax, and TransUnion show your knowledge otherwise. Listed below are the 4 widespread classes of data:

Private Info

A listing of particulars that determine you is included within the private data part of your credit score report. Your title, present and former addresses, social safety quantity, date of delivery, partner or co-applicant data, and telephone numbers are all listed on the prime of the report. This data is up to date primarily based on the info you give lenders whenever you apply for brand spanking new credit score.

Credit score Accounts

This part makes up nearly all of most studies. It incorporates full particulars on all of your credit score accounts, together with installment loans, auto loans, private loans, and mortgages, in addition to revolving credit score like bank cards and contours of credit score. Every reported account can be labeled as Open, Closed, or Detrimental. The main points about all missed funds, charge-offs, or collections actions, are additionally included.

Credit score Inquiries

This part of your credit score report retains account of the inquiries made by companies searching for your credit score report or credit score rating. Your requests for credit score can immediate arduous or delicate inquiries. Bear in mind that whenever you apply for pre-approved credit score, if there’s a arduous credit score verify, These inquiries can keep in your credit score report for as much as two years.

Public Document and Collections

Public information about monetary actions, similar to judgments, tax liens, and bankruptcies, are included on this part. When you file for chapter, you may discover the specifics of your chapter submitting and its standing listed on this credit score report part. Relying on the kind of chapter you apply for, the data will seem and keep in your credit score report for seven or ten years.

It’s important to usually verify the data in your credit score report to make sure that your lenders see probably the most correct credit score scores whenever you apply for credit score. You should notify the related credit score bureau in the event you uncover a mistake in your document.

How Typically Ought to You Test Your Credit score Report?

In response to specialists, it is best to verify your credit score report and rating at the very least as soon as yearly. The data on the credit score studies of all three main credit score reporting businesses can fluctuate, typically by greater than you’ll anticipate. It is best to overview all three to realize an intensive image of your creditworthiness.

Other than the common annual credit score checkup, it is best to overview your credit score report earlier than making important monetary selections. An additional benefit to persistently checking in in your credit score studies is that you’ll acquire insights into potential fraud or id theft.

You would possibly wish to arrange fraud alerts or a credit score freeze in the event you detect any indicators of id theft inflicting errors in your credit score report. It is best to contact one of many three foremost credit score bureaus to arrange alerts. Whenever you report a fraud alert to 1 credit score bureau, that bureau will contact the opposite two bureaus in your behalf. Freezing your credit score will not injury your rating, and chances are you’ll unfreeze it every time that you must apply for any mortgage or bank card.

Who Seems at Your Credit score Report and Why?

Some lenders use these studies to make well-informed selections about whether or not or to not lend you cash and what rates of interest to cost you. In some instances, your credit score report can be utilized by lenders to evaluate whether or not you’ll proceed to stick to the phrases of an present credit score account.

Apart from banks and different monetary establishments, your credit score report is essential for quite a few companies to make selections about you. Potential landlords can look at your credit score report earlier than they resolve whether or not to lease to you. Some organizations even carry out credit score checks on candidates as a part of their hiring course of.

Does Requesting a Credit score Report Harm Your Rating?

No, checking your credit score studies or scores doesn’t have an effect on your credit score rankings. Common checkups are essential in making certain the accuracy of your private and account data and might help in figuring out potential id theft. Requesting on your credit score report is an ideal instance of a delicate inquiry. Your credit score scores are unaffected by delicate credit score checks, that are solely seen to you whenever you verify your credit score report below the credit score inquiries part.

Distinction Between Credit score Report and Credit score Rating

A credit score rating is a single numerical ranking. In distinction, a credit score report collects knowledge about your credit score exercise and present credit score scenario. Your credit score studies considerably affect your credit score scores. That is as a result of knowledge out of your credit score studies is used to assemble credit score rankings. Take into account your scores as a quick synopsis of your credit score report. For that reason, cleansing up the studies is step one to bettering your credit score rating.

Identical to credit score scores, you might have varied credit score studies. Scores may change relying on the info used to generate them.

Conclusion

A credit score report information how you might have beforehand dealt with and repaid debt. When contemplating whether or not to do enterprise with you, lenders and different corporations use it as a type of a report card. Due to this fact, reviewing your credit score studies will help you in understanding your scenario and figuring out any fraud or inaccuracies together with your accounts.

Do not forget that it isn’t the tip of the world if a debt assortment exhibits up in your credit score document. Whereas there will not be any fast cures for fixing your credit score, there are undoubtedly simple steps you need to use to lift your credit score scores over a while.