An Installment mortgage is a basic time period used for examples of private and industrial loans. It’s a sort of mortgage the place you’ll be able to borrow a set sum of money. In contrast to a bank card or a credit score line, that are types of revolving credit score, you could decide the sum of money you want earlier than borrowing.

You repay the mortgage over a hard and fast interval that you just and your lender agree upon earlier than you get your mortgage. It is typical to make month-to-month funds, however some agreements can fluctuate. Each fee you make is known as an installment, which is why it’s an installment mortgage. Each fee will embrace paying off the principal of the quantity borrowed and the curiosity in your debt.

An installment mortgage can have a reimbursement time of months or years. The rate of interest could possibly be everlasting or adjustable, indicating it could actually go greater or decrease in the course of the mortgage time period. Installment loans may embrace supplementary prices, for instance, utility or overdue charges. It is vital to overview the mortgage contract earlier than taking out a mortgage to understand exactly how a lot you may must repay.

There are two forms of installment loans; unsecured or secured. An unsecured mortgage doesn’t want any type of collateral, solely a promise to pay again the debt. Consider medical debt, private loans, or bank cards. A secured installment mortgage is backed by an asset equal to the quantity being borrowed. Mortgages or automotive loans are examples of a secured mortgage.

Examples of Installment Loans

Mortgage:

A mortgage is a mortgage that you just use to buy a house. The house itself is collateral, so should you’re incapable of constructing funds each month, your lender may take possession of it. Mortgages are structured in 10, 15, or 30-year phrases. This mortgage can have both a everlasting or adjustable rate of interest. You may additionally must pay for closing prices and, presumably, non-public mortgage insurance coverage in case your down fee is lower than 20% of the worth of your private home.

Automobile Mortgage:

Just like mortgages, a automotive mortgage makes use of your automobile as collateral. Your lender will repossess your automobile should you do not make funds as agreed. Automobile loans characteristically require a down fee. The more cash you pay upfront, the much less your installment mortgage will probably be. Automobile mortgage phrases normally are 36 to 72 months, however longer durations have gotten widespread.

Private Loans:

Private installment loans are used for quite a few causes, reminiscent of consolidating debt or protecting a sudden expense. Private loans are unsecured, that means they don’t seem to be backed by collateral like mortgages or automotive loans. Consequently, their rates of interest will probably be greater, relying in your credit score historical past. You may take out a private mortgage between $1,000 and $50,000 with reimbursement occasions of two to 5 years.

What Are the Execs and Cons of Installment Loans?

To higher perceive if this mortgage is best for you, it is good to know the advantages and the drawbacks. Try the professionals and cons of installment loans:

Execs

- Fastened funds – Normally, installment loans will include predictable funds, making it simpler to regulate your price range.

- Outlined payoff date – There’s consolation in realizing {that a} specified date will repay your debt.

- Fastened APR – Relying in your mortgage, you’re assured the identical fee no matter fluctuations out there.

- Improved credit score combine – Managing various kinds of credit score exhibits lenders that you’re a accountable borrower.

- Construct credit score – Make your funds on time, and your rating will enhance.

Cons

- Fastened quantity – You may’t borrow more cash after the mortgage settlement is signed like you’ll be able to with a bank card or line of credit score.

- Primarily based on credit score – Your lender will cost the next rate of interest in case your credit score historical past is not wholesome.

- Licensed penalties and costs – Some lenders could cost utility charges or prepayment charges.

- Want collateral – You might be required to safe an asset of worth to qualify in your mortgage.

How Are Installment Loans Used?

Installment loans could be a better option than different credit score sources (for instance, bank cards) since their rates of interest are decrease and glued. Whereas it could be handy to place all of your bills in your bank card, it is steadily a smart monetary choice to evaluate your purchases and just remember to aren’t overspending on curiosity and funds.

Makes use of for Unsecured Installment Loans

Managing an surprising expense

Installment loans may help you cope with any unexpected bills. A buddy or relative may need assistance to pay for a surgical process not coated by their insurance coverage. Your automobile may find yourself in an accident or want a restore. You may’t at all times plan and even afford medical and automotive restore prices, however they will shortly trigger monetary stress. Paying these payments again in month-to-month installments could make strenuous bills inside your means.

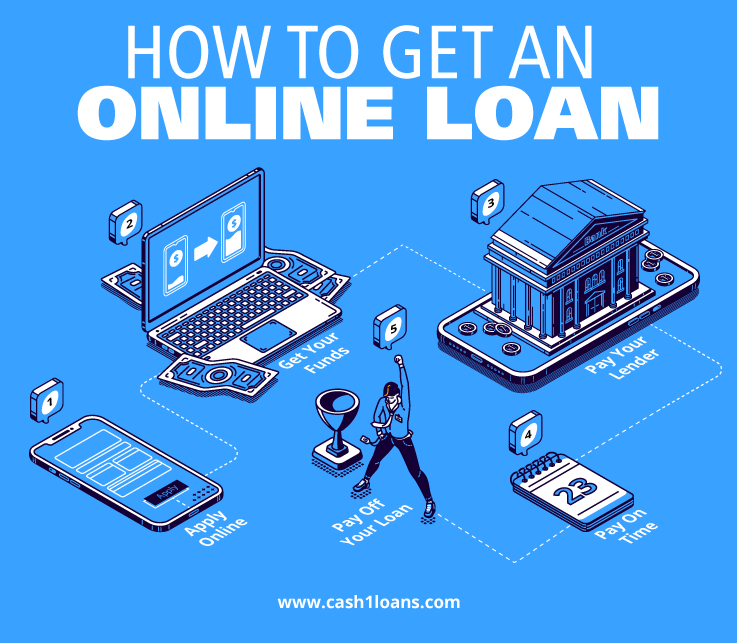

Should you want the cash quick, it is price wanting into on-line loans. Many lenders have quick and uncomplicated purposes that may allow you to get your money in days.

Investing in your self

Throughout your profession, there will probably be quite a few occasions when it’s important to put money into your self. You may must pay for certifications, purchase new tools, or switch to a distinct metropolis for an additional job. Many of those bills would require an upfront funding that you just may not be able to paying for immediately. In case you are assured these investments will repay, you need to use a private mortgage to get the cash upfront and pay it again over time.

Getting the next schooling

You probably have scholar loans, you in all probability have extra familiarity with installment loans than you care to confess. Most of these loans may be issued by the federal authorities or a non-public lender.

The U.S. Division of Schooling processes and approves scholar assist from the federal authorities. The advantages embrace compensation plans set by your earnings and glued rates of interest.

A scholar mortgage from a non-public lender reminiscent of a credit score union, financial institution, or a state-affiliated group has your phrases and circumstances set by that lender. Personal loans for schooling are thought-about costlier than federal scholar loans.

Makes use of for Secured Installment Loans

Buying a automotive

Automobile loans are the most typical forms of installment loans. If you do not have the cash to cowl the direct fees of buying a automotive, installment loans may help disadvantaged you of going into chapter 11.

Buying a home

Shopping for a home will almost definitely be the most important buy of your life. As a result of it is unlikely you may have all the cash wanted to purchase a house, there are lots of forms of mortgages available should you meet the necessities.

The Backside Line

Installment loans may help you accomplish your monetary aims, like shopping for a home or furthering your schooling, by allowing you to pay again your mortgage over an prolonged interval. Making funds on time and ultimately paying off the mortgage will enhance your credit score.

If you end up in a monetary bind, CASH 1 gives short-term installment loans in Utah, Arizona, and Nevada.

An Installment mortgage is a basic time period used for examples of private and industrial loans. It’s a sort of mortgage the place you’ll be able to borrow a set sum of money. In contrast to a bank card or a credit score line, that are types of revolving credit score, you could decide the sum of money you want earlier than borrowing.

You repay the mortgage over a hard and fast interval that you just and your lender agree upon earlier than you get your mortgage. It is typical to make month-to-month funds, however some agreements can fluctuate. Each fee you make is known as an installment, which is why it’s an installment mortgage. Each fee will embrace paying off the principal of the quantity borrowed and the curiosity in your debt.

An installment mortgage can have a reimbursement time of months or years. The rate of interest could possibly be everlasting or adjustable, indicating it could actually go greater or decrease in the course of the mortgage time period. Installment loans may embrace supplementary prices, for instance, utility or overdue charges. It is vital to overview the mortgage contract earlier than taking out a mortgage to understand exactly how a lot you may must repay.

There are two forms of installment loans; unsecured or secured. An unsecured mortgage doesn’t want any type of collateral, solely a promise to pay again the debt. Consider medical debt, private loans, or bank cards. A secured installment mortgage is backed by an asset equal to the quantity being borrowed. Mortgages or automotive loans are examples of a secured mortgage.

Examples of Installment Loans

Mortgage:

A mortgage is a mortgage that you just use to buy a house. The house itself is collateral, so should you’re incapable of constructing funds each month, your lender may take possession of it. Mortgages are structured in 10, 15, or 30-year phrases. This mortgage can have both a everlasting or adjustable rate of interest. You may additionally must pay for closing prices and, presumably, non-public mortgage insurance coverage in case your down fee is lower than 20% of the worth of your private home.

Automobile Mortgage:

Just like mortgages, a automotive mortgage makes use of your automobile as collateral. Your lender will repossess your automobile should you do not make funds as agreed. Automobile loans characteristically require a down fee. The more cash you pay upfront, the much less your installment mortgage will probably be. Automobile mortgage phrases normally are 36 to 72 months, however longer durations have gotten widespread.

Private Loans:

Private installment loans are used for quite a few causes, reminiscent of consolidating debt or protecting a sudden expense. Private loans are unsecured, that means they don’t seem to be backed by collateral like mortgages or automotive loans. Consequently, their rates of interest will probably be greater, relying in your credit score historical past. You may take out a private mortgage between $1,000 and $50,000 with reimbursement occasions of two to 5 years.

What Are the Execs and Cons of Installment Loans?

To higher perceive if this mortgage is best for you, it is good to know the advantages and the drawbacks. Try the professionals and cons of installment loans:

Execs

- Fastened funds – Normally, installment loans will include predictable funds, making it simpler to regulate your price range.

- Outlined payoff date – There’s consolation in realizing {that a} specified date will repay your debt.

- Fastened APR – Relying in your mortgage, you’re assured the identical fee no matter fluctuations out there.

- Improved credit score combine – Managing various kinds of credit score exhibits lenders that you’re a accountable borrower.

- Construct credit score – Make your funds on time, and your rating will enhance.

Cons

- Fastened quantity – You may’t borrow more cash after the mortgage settlement is signed like you’ll be able to with a bank card or line of credit score.

- Primarily based on credit score – Your lender will cost the next rate of interest in case your credit score historical past is not wholesome.

- Licensed penalties and costs – Some lenders could cost utility charges or prepayment charges.

- Want collateral – You might be required to safe an asset of worth to qualify in your mortgage.

How Are Installment Loans Used?

Installment loans could be a better option than different credit score sources (for instance, bank cards) since their rates of interest are decrease and glued. Whereas it could be handy to place all of your bills in your bank card, it is steadily a smart monetary choice to evaluate your purchases and just remember to aren’t overspending on curiosity and funds.

Makes use of for Unsecured Installment Loans

Managing an surprising expense

Installment loans may help you cope with any unexpected bills. A buddy or relative may need assistance to pay for a surgical process not coated by their insurance coverage. Your automobile may find yourself in an accident or want a restore. You may’t at all times plan and even afford medical and automotive restore prices, however they will shortly trigger monetary stress. Paying these payments again in month-to-month installments could make strenuous bills inside your means.

Should you want the cash quick, it is price wanting into on-line loans. Many lenders have quick and uncomplicated purposes that may allow you to get your money in days.

Investing in your self

Throughout your profession, there will probably be quite a few occasions when it’s important to put money into your self. You may must pay for certifications, purchase new tools, or switch to a distinct metropolis for an additional job. Many of those bills would require an upfront funding that you just may not be able to paying for immediately. In case you are assured these investments will repay, you need to use a private mortgage to get the cash upfront and pay it again over time.

Getting the next schooling

You probably have scholar loans, you in all probability have extra familiarity with installment loans than you care to confess. Most of these loans may be issued by the federal authorities or a non-public lender.

The U.S. Division of Schooling processes and approves scholar assist from the federal authorities. The advantages embrace compensation plans set by your earnings and glued rates of interest.

A scholar mortgage from a non-public lender reminiscent of a credit score union, financial institution, or a state-affiliated group has your phrases and circumstances set by that lender. Personal loans for schooling are thought-about costlier than federal scholar loans.

Makes use of for Secured Installment Loans

Buying a automotive

Automobile loans are the most typical forms of installment loans. If you do not have the cash to cowl the direct fees of buying a automotive, installment loans may help disadvantaged you of going into chapter 11.

Buying a home

Shopping for a home will almost definitely be the most important buy of your life. As a result of it is unlikely you may have all the cash wanted to purchase a house, there are lots of forms of mortgages available should you meet the necessities.

The Backside Line

Installment loans may help you accomplish your monetary aims, like shopping for a home or furthering your schooling, by allowing you to pay again your mortgage over an prolonged interval. Making funds on time and ultimately paying off the mortgage will enhance your credit score.

If you end up in a monetary bind, CASH 1 gives short-term installment loans in Utah, Arizona, and Nevada.