Did you get a letter saying you are pre-qualified for a mortgage however do not know whether or not meaning you’ll get a mortgage or not? Is being pre-qualified the identical as being pre-approved? And which is best: getting pre-qualified or pre-approved for an internet mortgage? It is commonplace to get such questions or be confused between the phrases pre-approval and pre-qualification.

Lenders might imply various things when utilizing particular monetary terminologies to explain their mortgage utility and approval course of. Likewise, some additionally use pre-approval and pre-qualification interchangeably, however they primarily symbolize two totally different phases of a mortgage course of.

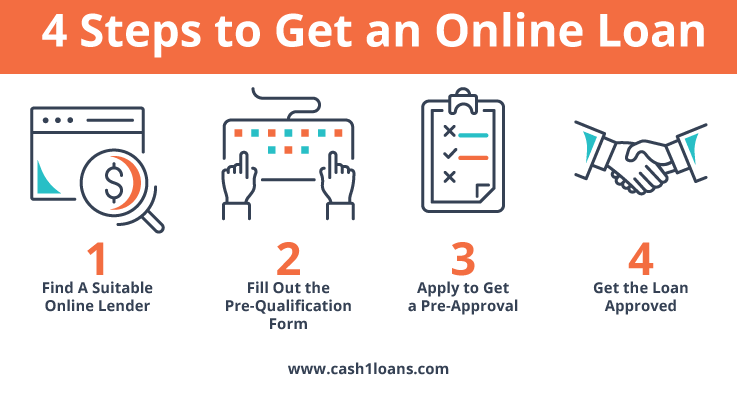

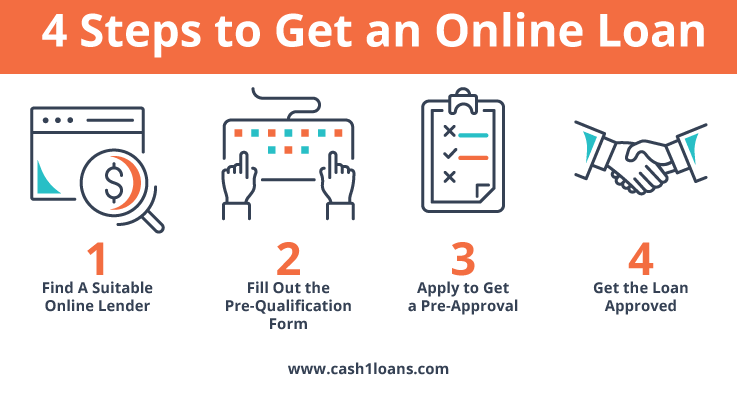

Here is a primary course of movement to present you a good thought of when you possibly can apply to get pre-qualified and pre-approved for an internet mortgage.

APPLY NOW

4 Steps to Get an On-line Mortgage

When making use of for a private mortgage on-line, there are some important monetary phrases that each borrower ought to perceive to keep away from any disagreeable surprises. So, we’ll stroll you thru the that means of the phrases pre-approval and pre-qualification, how they differ from each other, and present you the way they’ll make your mortgage expertise seamless and accessible.

What Does a Pre-Certified Mortgage Imply?

Pre-qualification is a preparatory stage in your mortgage course of that offers you an estimate of the mortgage quantity you possibly can count on to obtain. Lenders who present an choice to pre-qualify for a mortgage require you to fill out an utility to provoke the method. Although the data wanted for pre-qualification might fluctuate from lender to lender, most lenders solely ask for primary particulars about your monetary state of affairs with out affecting your credit score. When you pre-qualify, you will be despatched a pre-qualification letter from the lender inside one to 3 days. It is then as much as you to simply accept or decline the pre-qualified provide.

The pre-qualification possibility might be useful, particularly when attempting to find a mortgage that fits your finances and wishes. You may submit your primary monetary particulars to varied lenders, get a pre-qualified quantity, and make an knowledgeable determination. Bear in mind, a pre-qualified mortgage quantity shouldn’t be confused with the pre-approved quantity or the ultimate mortgage provide. A lender would require extra data in case you determine to get pre-approval or apply for a mortgage after being pre-qualified.

The aim of getting pre-qualified by a lender is to evaluate the chance of you qualifying for a mortgage. This implies there are additionally possibilities that you just won’t pre-qualify for a mortgage.

What If You Do not Pre-qualify For An On-line Mortgage?

Being turned down for pre-qualification is undoubtedly not the top of the world. Through the use of just a few simple ideas to enhance your credit score rating, you would possibly be capable of enhance the chance of your on-line mortgage utility getting pre-qualified. pre-qualify We all know this might take some time and so listed below are some steps that you would be able to take as quickly as you get denied for pre-qualification:

1. Attain Out to the Lender:

There are possibilities {that a} lender won’t be capable of decide your precise creditworthiness from the fundamental monetary data you shared. You may discuss to the lender to make sure and supply extra particulars or discover out why your pre-qualification utility was rejected that will help you work on enhancing your probabilities of getting permitted sooner or later.

2. Think about Including a Co-signer:

In case your lender permits, you would add a co-signer with good credit score to your mortgage utility. Fortuitously, a cosign mortgage will help you qualify for an internet mortgage even with a low credit score rating. For the reason that co-signer has no proper to the borrowed funds however is liable for making the funds in case you default, selecting an in depth member of the family, pal, partner, or mother or father as a co-signer is best.

3. Overview Your Credit score Report

The incorrect or incomplete data in your credit score report can negatively affect your credit score scores and make it tough so that you can pre-qualify for a mortgage. You may examine your credit score report without spending a dime and submit a dispute in case you discover any errors in your credit score report. The credit score reporting company is then liable for investigating and aiding you in rectifying the data.

If a lender would not pre-qualify your mortgage, you possibly can all the time discover different mortgage choices for weak credit. Not each lender prefers working solely with individuals having honest to glorious credit score. Since pre-qualification is fast, you would search for a lender prepared to lend you cash based mostly on elements apart from your credit score rating. After getting the pre-qualification letter, chances are you’ll proceed to get pre-approved for the mortgage.

APPLY NOW

What Is A Pre-Authorized Mortgage?

The mortgage pre-approval course of is barely extra rigorous than the pre-qualification one. Lenders carry out an intensive examine in your monetary background if you apply to get pre-approved for a mortgage. A pre-approval helps you establish whether or not you are eligible to get a mortgage or not, your potential mortgage quantity, and the perfect out there rate of interest for you. You will get all this data solely and provided that you get pre-approved. Like pre-qualification, the lender provides a pre-approval letter to all of the debtors who’ve proved their creditworthiness and are only one step away from getting the precise mortgage.

You will need to word that some lenders cost an utility price for pre-approval. Should you’re not in pressing want of money, you possibly can inquire about different on-line lending firms moderately than selecting the primary lender that gives you pre-approval. You’ll find lenders who solely run tender credit score checks to pre-approve an internet mortgage. By doing this, you cannot solely be certain that your credit score will not be affected by submitting a number of pre-approval functions however will not have to attend lengthy to get pre-approval letters from totally different lenders.

How Lengthy Can You Be Pre-Authorized For A Mortgage?

Your monetary state of affairs might not stay the identical, and since a pre-approval provide is predicated straight in your present monetary background, it could not final perpetually. Your pre-approval letter mentions the variety of days during which the mortgage pre-approval expires. The times to expiration (DTE) are usually not the identical throughout lenders, however a pre-approval letter is usually legitimate for wherever between 30 to 90 days. You will should determine inside this timeframe whether or not to undergo the ultimate mortgage course of or not.

You may neither prolong nor renew your pre-approved provide if it is about to run out. And as soon as your pre-approval has expired, you will should run by means of the pre-approval and possibly pre-qualification utility course of another time.

What’s The Distinction Between Pre-qualification And Pre-Approval?

In line with the Shopper Monetary Safety Bureau, there is a very skinny line between a pre-qualified and a pre-approved mortgage. Nonetheless, the 2 phrases have typically created an enormous confusion in debtors’ minds. So, this is a desk summarizing the important thing variations between pre-approval and pre-qualification:

Differentiating Elements Pre-Approval Pre-Qualification The Goal Gives a preliminary mortgage provide that mentions the mortgage quantity and rate of interest. Gives an estimate of how a lot the lender could also be prepared to lend. Want for Credit score Verify Relying on the lender, it would require a tender or laborious credit score examine. It could require a tender credit score inquiry or no credit score examine in any respect. Processing Time On account of in depth background checks, you’ll have to attend for the pre-approval response from up to a couple days to 2 weeks. The pre-qualification course of is way sooner than the pre-approval course of. You would possibly obtain a response1-4 in days. Lock the Curiosity Fee You could possibly lock in your rate of interest for as much as 120 days. You will get an rate of interest estimate, however might not be capable of lock within the rate of interest. Necessities Require an intensive evaluation of your funds by verifying all of the monetary paperwork requested by the lender. Requires primary particulars about your monetary state of affairs which might be offered verbally or on-line.

Why Getting Pre-Authorized Or Pre-Certified Is Vital?

By now, you’ll have understood that each pre-approval and pre-qualification do not assure you a mortgage. Nonetheless, there are some intangible advantages of getting a pre-approval or a pre-qualification letter:

- Getting a tough thought of the mortgage quantity might assist in case your present finances will be capable of deal with the month-to-month funds of a brand new mortgage or not.

- You could possibly discover any errors or want to enhance your credit score when the lenders look at your funds as a part of the pre-approval and pre-qualification course of.

- It could make you appear to be a real and potential borrower.

APPLY NOW

Backside Line

With an growing variety of lenders out there, one would possibly get confused whereas choosing the proper on-line mortgage. Issues can get much more tough when you find yourself unclear about particular phrases of the mortgage course of. By means of this text, now we have tried to familiarize you with the phrases pre-approved vs. pre-qualified, which may help you in figuring out an appropriate lender and mortgage with out affecting your credit score rating. Nonetheless, totally different lenders seek advice from pre-approval and pre-qualification in another way, so all the time examine with them earlier than continuing additional of their mortgage course of.

Did you get a letter saying you are pre-qualified for a mortgage however do not know whether or not meaning you’ll get a mortgage or not? Is being pre-qualified the identical as being pre-approved? And which is best: getting pre-qualified or pre-approved for an internet mortgage? It is commonplace to get such questions or be confused between the phrases pre-approval and pre-qualification.

Lenders might imply various things when utilizing particular monetary terminologies to explain their mortgage utility and approval course of. Likewise, some additionally use pre-approval and pre-qualification interchangeably, however they primarily symbolize two totally different phases of a mortgage course of.

Here is a primary course of movement to present you a good thought of when you possibly can apply to get pre-qualified and pre-approved for an internet mortgage.

APPLY NOW

4 Steps to Get an On-line Mortgage

When making use of for a private mortgage on-line, there are some important monetary phrases that each borrower ought to perceive to keep away from any disagreeable surprises. So, we’ll stroll you thru the that means of the phrases pre-approval and pre-qualification, how they differ from each other, and present you the way they’ll make your mortgage expertise seamless and accessible.

What Does a Pre-Certified Mortgage Imply?

Pre-qualification is a preparatory stage in your mortgage course of that offers you an estimate of the mortgage quantity you possibly can count on to obtain. Lenders who present an choice to pre-qualify for a mortgage require you to fill out an utility to provoke the method. Although the data wanted for pre-qualification might fluctuate from lender to lender, most lenders solely ask for primary particulars about your monetary state of affairs with out affecting your credit score. When you pre-qualify, you will be despatched a pre-qualification letter from the lender inside one to 3 days. It is then as much as you to simply accept or decline the pre-qualified provide.

The pre-qualification possibility might be useful, particularly when attempting to find a mortgage that fits your finances and wishes. You may submit your primary monetary particulars to varied lenders, get a pre-qualified quantity, and make an knowledgeable determination. Bear in mind, a pre-qualified mortgage quantity shouldn’t be confused with the pre-approved quantity or the ultimate mortgage provide. A lender would require extra data in case you determine to get pre-approval or apply for a mortgage after being pre-qualified.

The aim of getting pre-qualified by a lender is to evaluate the chance of you qualifying for a mortgage. This implies there are additionally possibilities that you just won’t pre-qualify for a mortgage.

What If You Do not Pre-qualify For An On-line Mortgage?

Being turned down for pre-qualification is undoubtedly not the top of the world. Through the use of just a few simple ideas to enhance your credit score rating, you would possibly be capable of enhance the chance of your on-line mortgage utility getting pre-qualified. pre-qualify We all know this might take some time and so listed below are some steps that you would be able to take as quickly as you get denied for pre-qualification:

1. Attain Out to the Lender:

There are possibilities {that a} lender won’t be capable of decide your precise creditworthiness from the fundamental monetary data you shared. You may discuss to the lender to make sure and supply extra particulars or discover out why your pre-qualification utility was rejected that will help you work on enhancing your probabilities of getting permitted sooner or later.

2. Think about Including a Co-signer:

In case your lender permits, you would add a co-signer with good credit score to your mortgage utility. Fortuitously, a cosign mortgage will help you qualify for an internet mortgage even with a low credit score rating. For the reason that co-signer has no proper to the borrowed funds however is liable for making the funds in case you default, selecting an in depth member of the family, pal, partner, or mother or father as a co-signer is best.

3. Overview Your Credit score Report

The incorrect or incomplete data in your credit score report can negatively affect your credit score scores and make it tough so that you can pre-qualify for a mortgage. You may examine your credit score report without spending a dime and submit a dispute in case you discover any errors in your credit score report. The credit score reporting company is then liable for investigating and aiding you in rectifying the data.

If a lender would not pre-qualify your mortgage, you possibly can all the time discover different mortgage choices for weak credit. Not each lender prefers working solely with individuals having honest to glorious credit score. Since pre-qualification is fast, you would search for a lender prepared to lend you cash based mostly on elements apart from your credit score rating. After getting the pre-qualification letter, chances are you’ll proceed to get pre-approved for the mortgage.

APPLY NOW

What Is A Pre-Authorized Mortgage?

The mortgage pre-approval course of is barely extra rigorous than the pre-qualification one. Lenders carry out an intensive examine in your monetary background if you apply to get pre-approved for a mortgage. A pre-approval helps you establish whether or not you are eligible to get a mortgage or not, your potential mortgage quantity, and the perfect out there rate of interest for you. You will get all this data solely and provided that you get pre-approved. Like pre-qualification, the lender provides a pre-approval letter to all of the debtors who’ve proved their creditworthiness and are only one step away from getting the precise mortgage.

You will need to word that some lenders cost an utility price for pre-approval. Should you’re not in pressing want of money, you possibly can inquire about different on-line lending firms moderately than selecting the primary lender that gives you pre-approval. You’ll find lenders who solely run tender credit score checks to pre-approve an internet mortgage. By doing this, you cannot solely be certain that your credit score will not be affected by submitting a number of pre-approval functions however will not have to attend lengthy to get pre-approval letters from totally different lenders.

How Lengthy Can You Be Pre-Authorized For A Mortgage?

Your monetary state of affairs might not stay the identical, and since a pre-approval provide is predicated straight in your present monetary background, it could not final perpetually. Your pre-approval letter mentions the variety of days during which the mortgage pre-approval expires. The times to expiration (DTE) are usually not the identical throughout lenders, however a pre-approval letter is usually legitimate for wherever between 30 to 90 days. You will should determine inside this timeframe whether or not to undergo the ultimate mortgage course of or not.

You may neither prolong nor renew your pre-approved provide if it is about to run out. And as soon as your pre-approval has expired, you will should run by means of the pre-approval and possibly pre-qualification utility course of another time.

What’s The Distinction Between Pre-qualification And Pre-Approval?

In line with the Shopper Monetary Safety Bureau, there is a very skinny line between a pre-qualified and a pre-approved mortgage. Nonetheless, the 2 phrases have typically created an enormous confusion in debtors’ minds. So, this is a desk summarizing the important thing variations between pre-approval and pre-qualification:

Differentiating Elements Pre-Approval Pre-Qualification The Goal Gives a preliminary mortgage provide that mentions the mortgage quantity and rate of interest. Gives an estimate of how a lot the lender could also be prepared to lend. Want for Credit score Verify Relying on the lender, it would require a tender or laborious credit score examine. It could require a tender credit score inquiry or no credit score examine in any respect. Processing Time On account of in depth background checks, you’ll have to attend for the pre-approval response from up to a couple days to 2 weeks. The pre-qualification course of is way sooner than the pre-approval course of. You would possibly obtain a response1-4 in days. Lock the Curiosity Fee You could possibly lock in your rate of interest for as much as 120 days. You will get an rate of interest estimate, however might not be capable of lock within the rate of interest. Necessities Require an intensive evaluation of your funds by verifying all of the monetary paperwork requested by the lender. Requires primary particulars about your monetary state of affairs which might be offered verbally or on-line.

Why Getting Pre-Authorized Or Pre-Certified Is Vital?

By now, you’ll have understood that each pre-approval and pre-qualification do not assure you a mortgage. Nonetheless, there are some intangible advantages of getting a pre-approval or a pre-qualification letter:

- Getting a tough thought of the mortgage quantity might assist in case your present finances will be capable of deal with the month-to-month funds of a brand new mortgage or not.

- You could possibly discover any errors or want to enhance your credit score when the lenders look at your funds as a part of the pre-approval and pre-qualification course of.

- It could make you appear to be a real and potential borrower.

APPLY NOW

Backside Line

With an growing variety of lenders out there, one would possibly get confused whereas choosing the proper on-line mortgage. Issues can get much more tough when you find yourself unclear about particular phrases of the mortgage course of. By means of this text, now we have tried to familiarize you with the phrases pre-approved vs. pre-qualified, which may help you in figuring out an appropriate lender and mortgage with out affecting your credit score rating. Nonetheless, totally different lenders seek advice from pre-approval and pre-qualification in another way, so all the time examine with them earlier than continuing additional of their mortgage course of.